GLIA FOR CREDIT UNIONS

Scale Your Mission With AI for Credit Unions

Strengthen your service while unlocking AI efficiency. Glia’s AI workforce for credit unions helps you deepen relationships, grow assets, and deliver the personal care your community counts on.

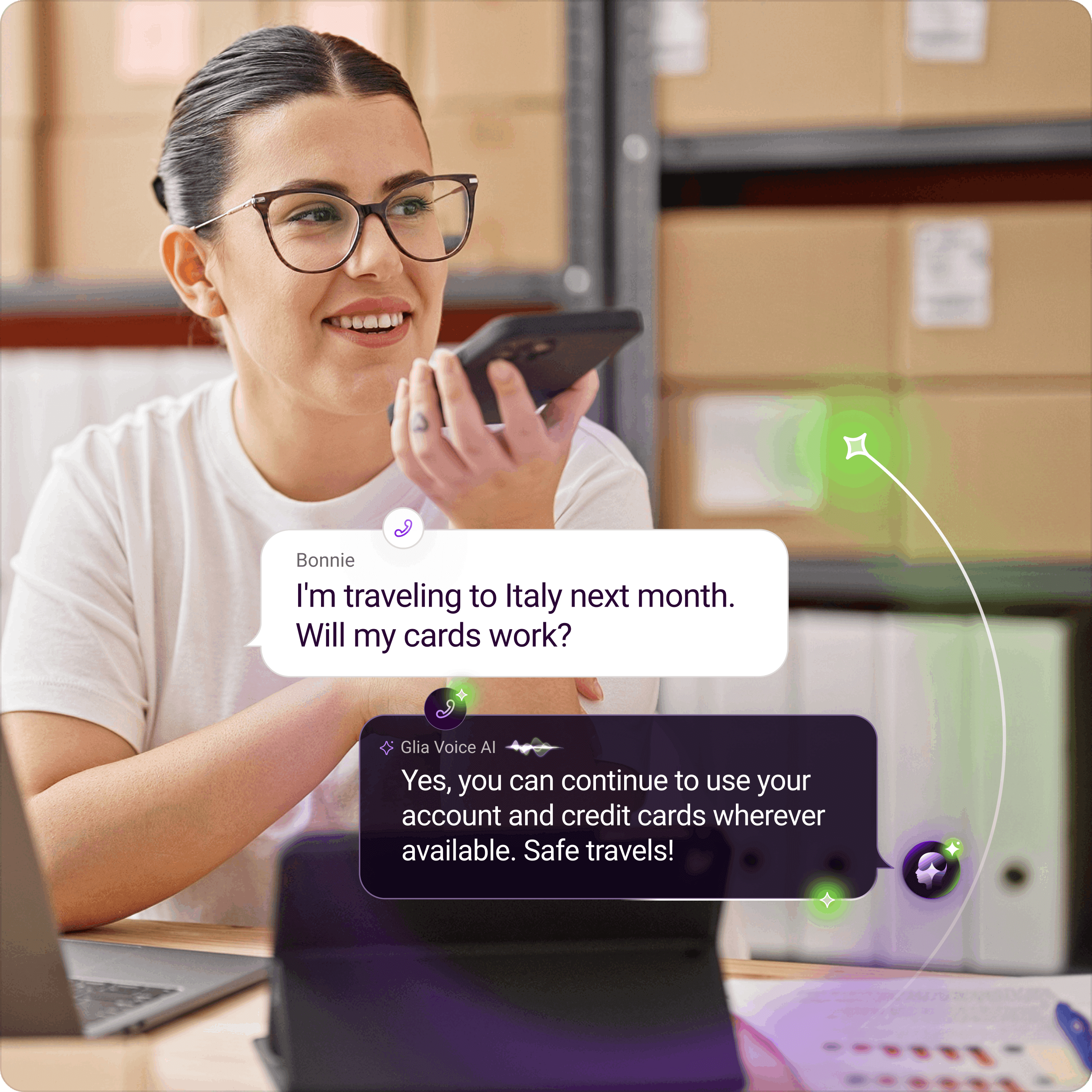

VOICE AI FOR CREDIT UNIONS

Double Workforce Capacity Without Adding Headcount

Glia voice AI answers up to 80% of your calls without help from agents, leaving just one question: What will your credit union do with 2x more capacity?

Right-Size Your Budget,

Expand Your Membership

Expand Your Membership

Stop backfilling open roles and start acquiring new members. Voice AI lets you handle more calls without hiring so you can expand territory and membership without adding costs for labor and physical branches.

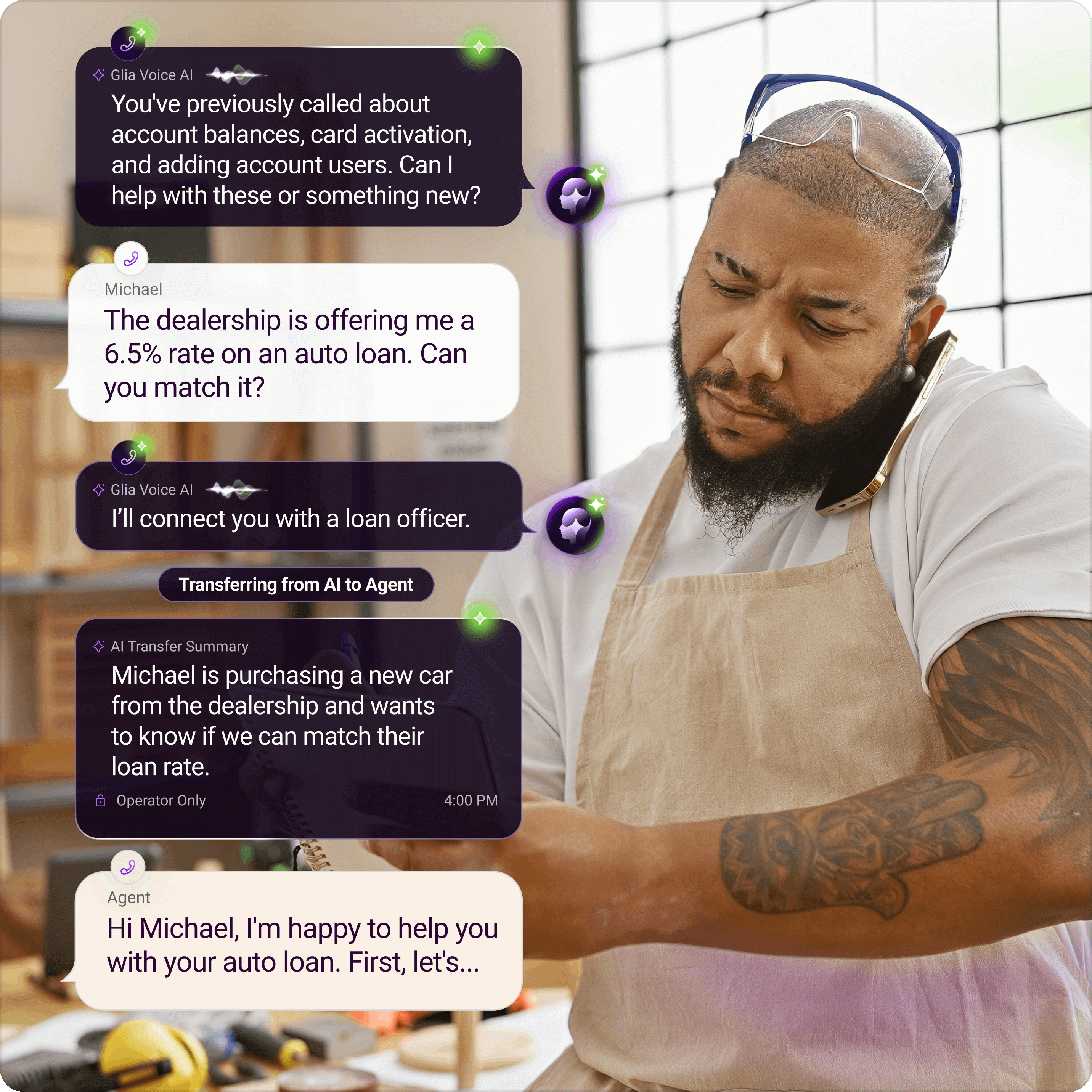

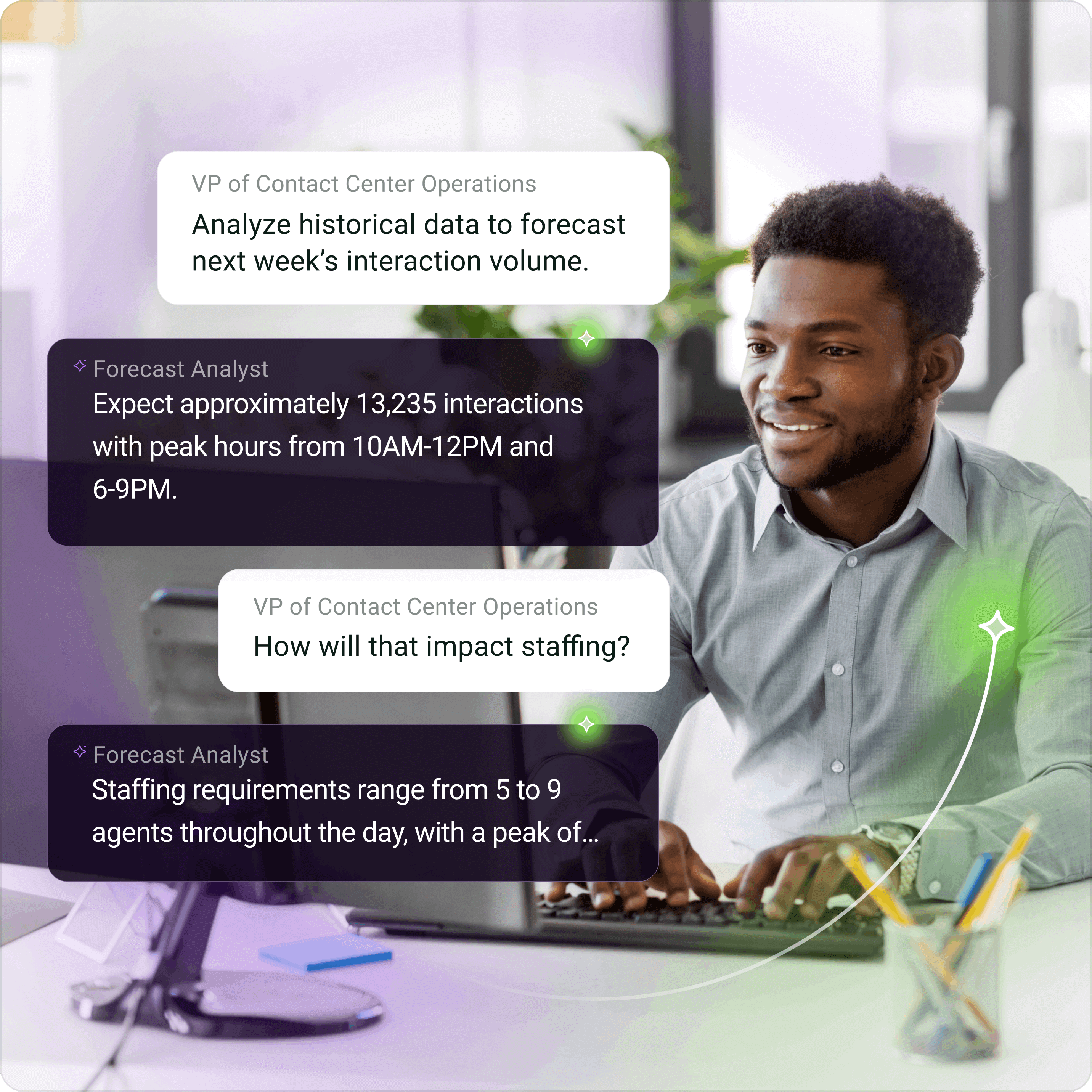

Reallocate Agents to Drive Deposits & Loan Growth

Use voice AI to deflect Tier-1 inquiries so agents can focus on converting loan and deposit opportunities, indirect lending follow-up, proactively reaching out to members about new products, and more.

Reinvest in Your Members, Staff, and Community

Get time back to educate members on financial literacy, empower agents to focus on career development, and free up budget for member dividends, community development, and charitable causes.

SUCCESS STORIES

How Credit Unions Win With Glia

Will AI compromise your member experience? Not when you choose a solution built for community financial institutions. See how Glia helps credit unions unlock AI efficiency and drive growth while enhancing the personal touch members love.

2.5x

Increase in YOY loans, now at 151%+ of annual target, with 25% less staff

2x

More volume handled—with 20% more workforce efficiency and no extra headcount

100%

Member interactions automated or enhanced by AI

18%

Decrease in average handle time

21%

increase in loan dollars from the digital center through the first half of 2025

100%

of calls answered by AI, with 37% fully handled by voice AI, freeing up digital center to focus on loan growth

96%

reduction in abandonment rate, 91% reduction in wait time

69

hours of agent time per week saved thanks to AI

%2520(1).jpeg)

4

new branches opened without adding headcount

1400

hours of manual agent work saved in four months

55%

decrease in call abandonment rate, lowered average handle time by 25%

4.7

average digital member satisfaction rate (out of 5.0)

97%

service level, improving by 30%

62%

decrease in abandonment rate

40%

reduction in average handle time

42%

increase in monthly service capacity

AI WORKFORCE FOR credit unions

Improve Member Care, Drive Efficiency, and Grow Assets

Handle Tier-1 inquiries with AI, free up agents to deepen relationships and drive revenue, and empower leaders to strategically plan for the future with AI insights. Glia’s AI workforce gives credit unions one platform to do it all.

THE GLIA DIFFERENCE

The Clear Choice for Credit Unions

Generic AI and CCaaS vendors don’t understand your credit union. Glia does. Find out how to end the efficiency vs. experience tradeoff by choosing a partner fully dedicated to community financial institutions like yours.

Built For Credit Unions Like Yours

Glia only works with financial institutions. Everything we build is engineered with your needs in mind—from voice AI that understands your members to integrations that work with your core to industry-specific compliance guardrails.

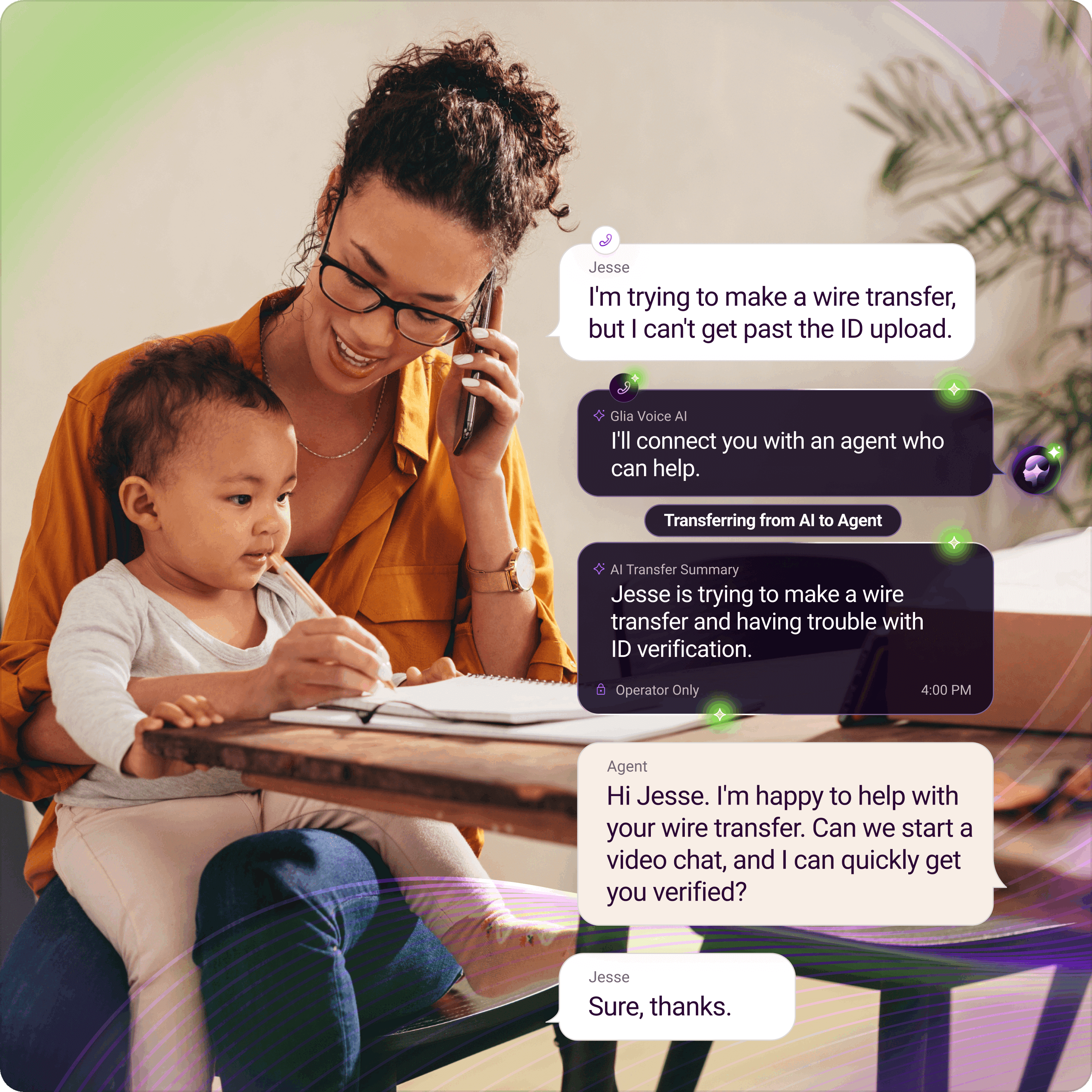

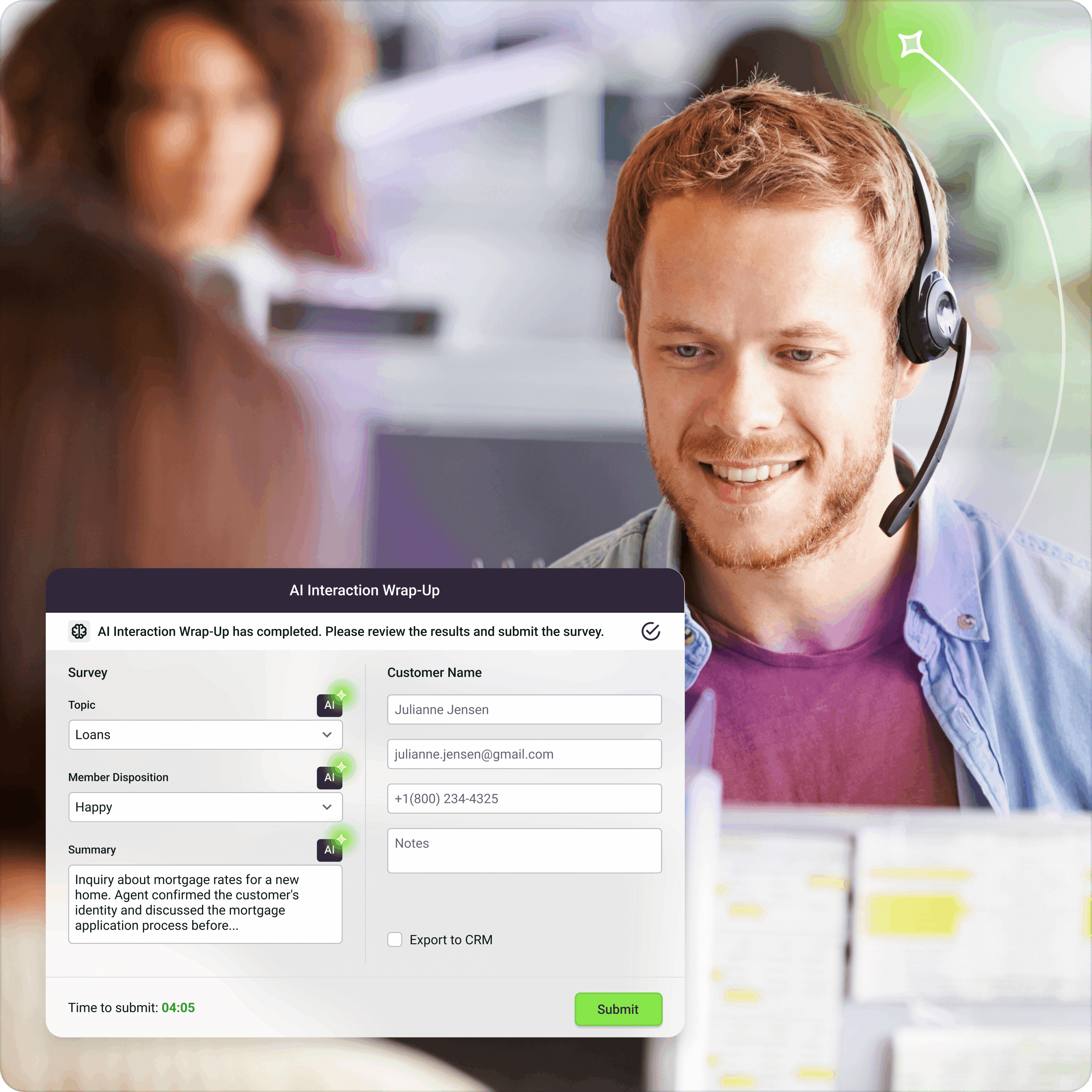

Unified Human & AI Workforce

Glia AI works hand-in-hand with your agents, while ChannelLess architecture ensures seamless handoffs between human and AI. Every interaction feeds an AI learning loop that helps you unlock compounding value over time.

Fastest Banking AI in the Industry

Keep your personal touch even as you scale. 50% faster than the nearest competitor, Glia voice AI delivers lower-latency, human-like responsiveness, giving every AI interaction that in-branch feeling.

Pricing That Rewards Growth

Reinvest savings into your credit union and member dividends, not your vendor. Our Priceless Pricing™ is transparent and predictable—unlimited seats, minutes, and AI capabilities, no hidden fees.

Aligned to Your Community Mission

Your community counts on you. You can count on us. With an industry-leading NPS score, our banking experts help you drive ROI and strengthen member interactions throughout your entire Glia journey.

Voice AI on Your Preferred Platform

Add voice AI at your own pace. Turn to the Glia platform for a fully unified voice and digital experience, or use our integrations to connect voice AI to your current CCaaS platform—no rip-and-replace required.

glia awards

Integrations for Credit Unions

From Cores to CRMs, 100+

Integrations for Credit Unions

The Glia platform is purpose-built for banking. So are our integrations. Glia connects with 100+ leading OLBs, cores, CRMs, and more so you can immediately drive value without the IT lift.

Online Banking 2

Lorem ipsum dolor sit amet consectetur. Semper ultricies congue pharetra odio neque pellentesque molestie sed dui. Mauris volutpat eget mattis augue.

Online Banking 3

Lorem ipsum dolor sit amet consectetur. Semper ultricies congue pharetra odio neque pellentesque molestie sed dui. Mauris volutpat eget mattis augue.

Online Banking 4

Lorem ipsum dolor sit amet consectetur. Semper ultricies congue pharetra odio neque pellentesque molestie sed dui. Mauris volutpat eget mattis augue.

Credit union testiMONIAL

Improving Lives Through Banking Interactions

AI, VOICE & DIGITAL CUSTOMER SERVICE

Credit Union Questions, Answered

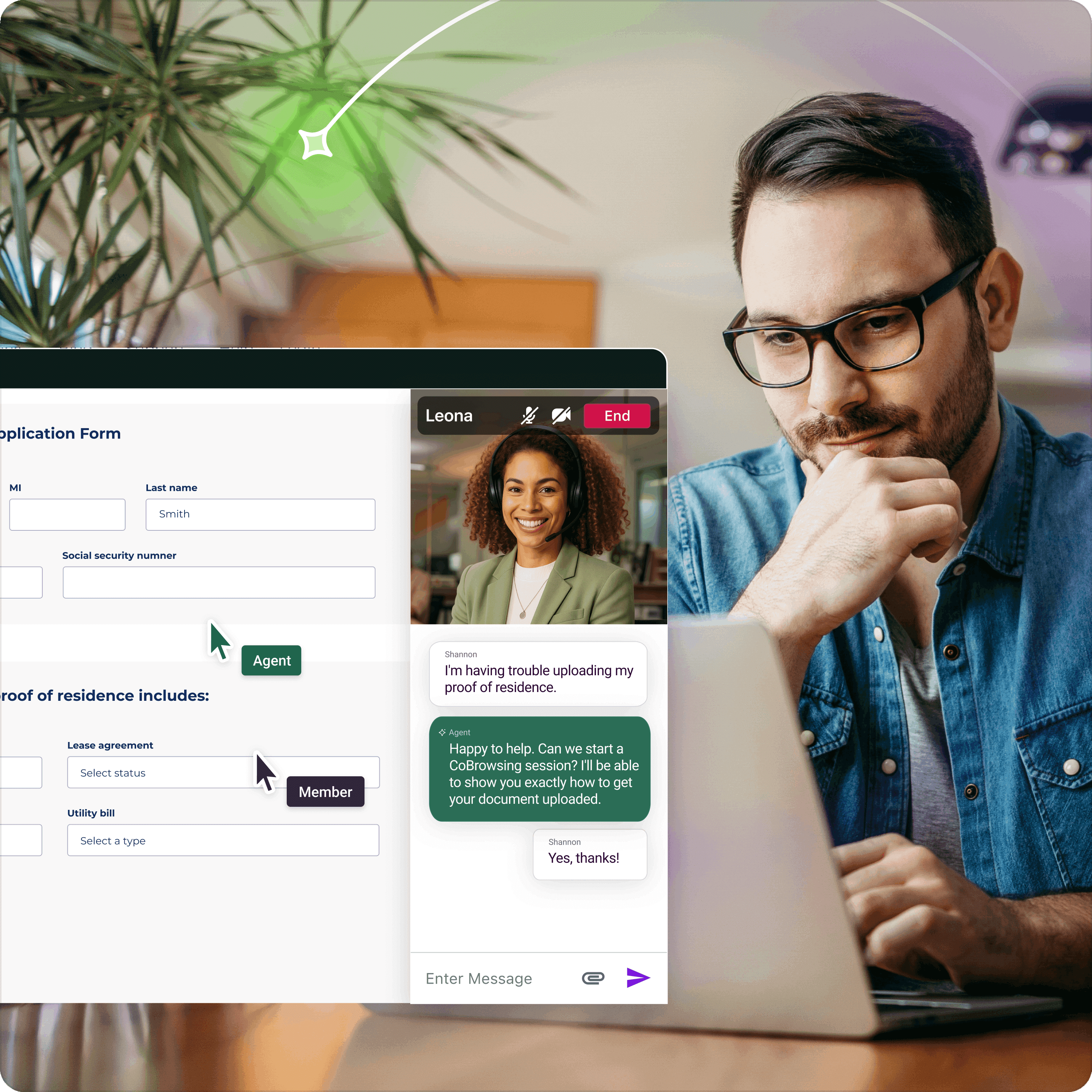

Digital customer service for credit unions enables financial institutions to serve members seamlessly through digital channels while maintaining personalized relationships. Digital customer service is essential because modern members expect convenient digital banking experiences with instant, contextual support. This comprehensive approach allows credit unions to meet evolving member needs while preserving their reputation for exceptional service.

Improving member satisfaction through digital customer service requires credit unions to deliver an integrated customer experience across digital channels. This means offering both self service capabilities and immediate access to live assistance through any service channel. By integrating digital banking solutions with personalized support, financial institutions can maintain their competitive advantage while strengthening member relationships.

Yes, Glia's platform seamlessly integrates with existing digital banking systems and core technologies. Our solution works alongside your current infrastructure to create a unified experience, ensuring representatives have access to relevant member information and can provide contextual assistance without requiring members to switch platforms or repeat information.